japan corporate tax rate 2017

Japan also slowly decreased its. The worldwide average statutory corporate income tax rate measured across 180 jurisdictions is 2354 percent.

Japan Annual Income Per Household 2021 Statista

However a branch and a Japanese company have differing legal.

. Reorganization into system where general tax credit rate sougakukei will be 6-14 for large companies and 12-17 for SMEs based upon the increase in the ratio of R. Corporate Tax Rates 2017 Corporate Income Tax Rates 2013-2017. Asia has the lowest regional average rate at 1962 percent while Africa has the highest regional average statutory rate at 2797 percent.

It also is proposed that the definition of certain. Historical Data by years Data Period Date Historical Chart by governors. Dec 2014 Japan Corporate tax rate.

2017 tax reform proposals in Japan. The United Arab Emirates has the worlds highest corporate tax rate and several Caribbean nations have the lowest. Beginning from 1 October 2019 corporate taxpayers are required to file and pay the national local corporate tax at a fixed rate of 103 of their corporate tax liabilities.

Effective Corporate Tax Rates With Alternative Allocations of Asset Shares in G20 Countries 2012 34 Figure B-2. Tax notification must also be submitted when a foreign corporation generates income subject to corporate tax in Japan without establishing a branch office ie where 2 of 334. Before 1 October 2019 the national local corporate tax rate was 44.

Effective Corporate Tax Rates With Alternative Rates of Inflation in G20 Countries 2012 35 Figure B-3. Measures the amount of taxes that Japanese businesses must pay as a share of corporate profits. When weighted by GDP the average statutory rate is 2544 percent.

Proposals that aim to promote growth include amendments to the RD tax credit regime and revisions to deductible compensation paid to directors. The credits are maximized to 25 of the amount of corporate tax due in case of regular RD expenses. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after cutting it.

The Revenue Reconciliation Act of 1993 increased the maximum corporate tax rate to 35 for corporations with taxable income over 10 million. Latest data on Corporate Tax Rate Chart Historical Chart What is Corporate Tax Rate in Japan. Effective Corporate Tax Rates With Uniform and Country-Specific Rates of Inflation in G20 Countries 2012 37 Figure B-4.

The corporate tax rate in Japan for a branch is the same as for a subsidiary. Corporate Tax Rate in Japan remained unchanged at 3062 in 2021. At present Japans corporate tax rate is 3211 percent.

Global tax rates 2017 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS. Rates reflected are statutory national rates. The maximum rate was 524 and minimum was 3062.

For tax years beginning after 2017 the Tax Cuts and Jobs Act PL. Donations and the corporate income tax rates are the same for both a branch and a Japanese company. On 8 December 2016 Japans Liberal Democratic Party and the Komeito Party released tax reform proposals for 2017.

In the world as of 2017to 21 in 2018. The government initially planned to reduce the rate to below 30 percent in fiscal 2017 after. Data published Yearly by National Tax Agency.

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited a UK private company limited by guarantee DTTL its. Global tax rates 2017 provides corporate income tax historic corporate income tax and domestic withholding tax rates for more than 170 countries. 115-97 replaced the graduated corporate tax structure with a flat 21 corporate tax rate.

Standard enterprise tax and local corporate special tax.

Part V World Inequality Report 2018

Corporate Profit Shifting And The Role Of Tax Havens Evidence From German Country By Country Reporting Data Eutax

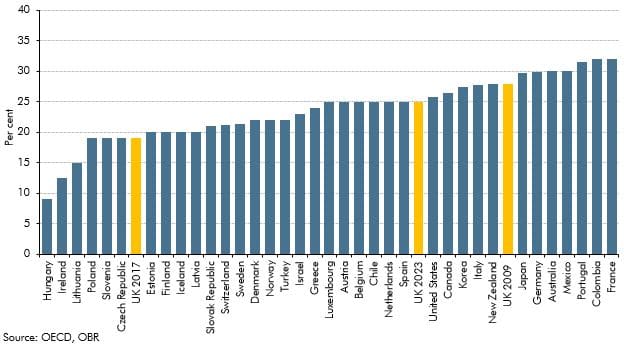

Corporation Tax In Historical And International Context Office For Budget Responsibility

Fact Check Does The U S Have The Highest Corporate Tax Rate In The World Npr

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Doing Business In The United States Federal Tax Issues Pwc

Austria Tax Income Taxes In Austria Tax Foundation

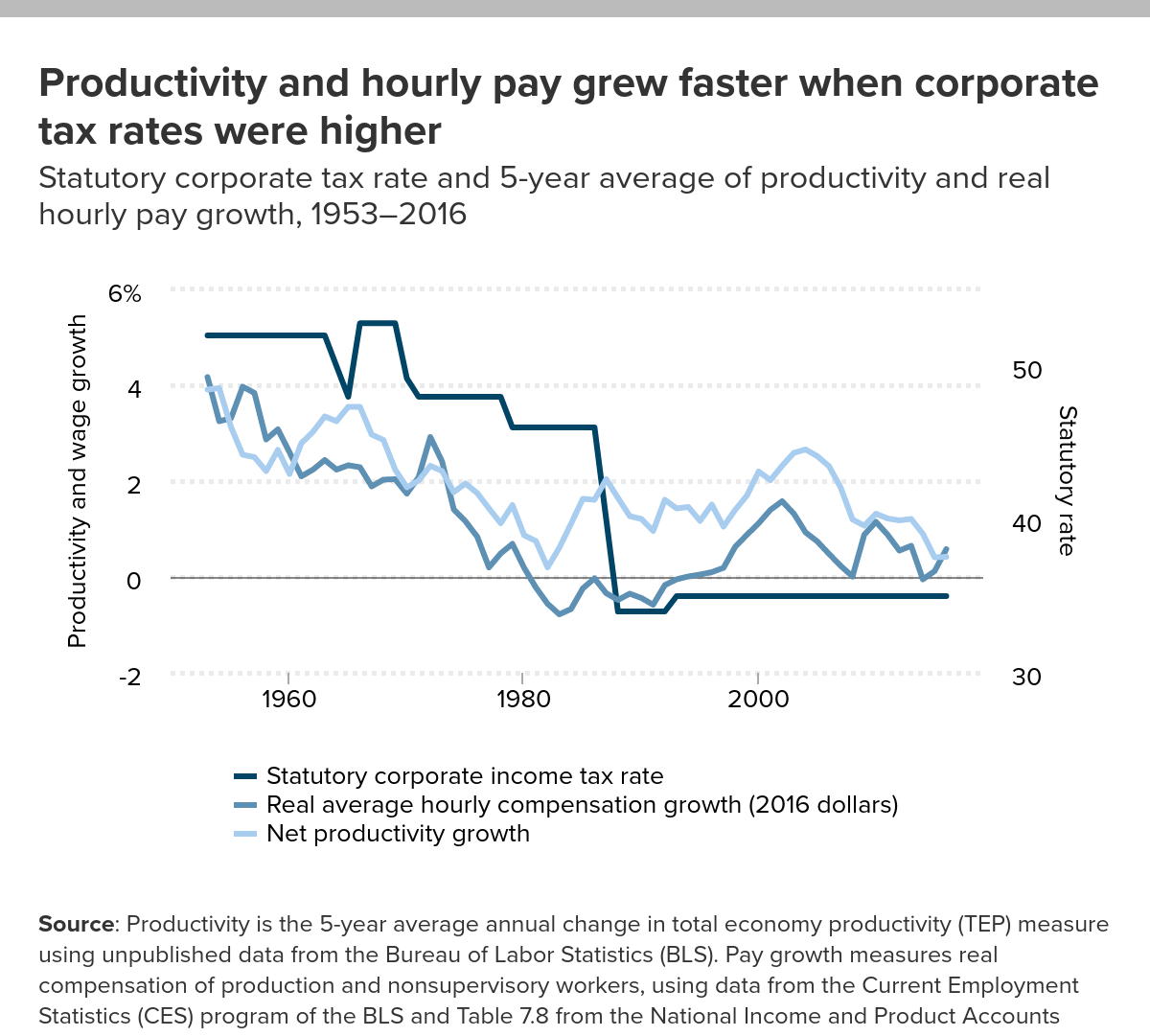

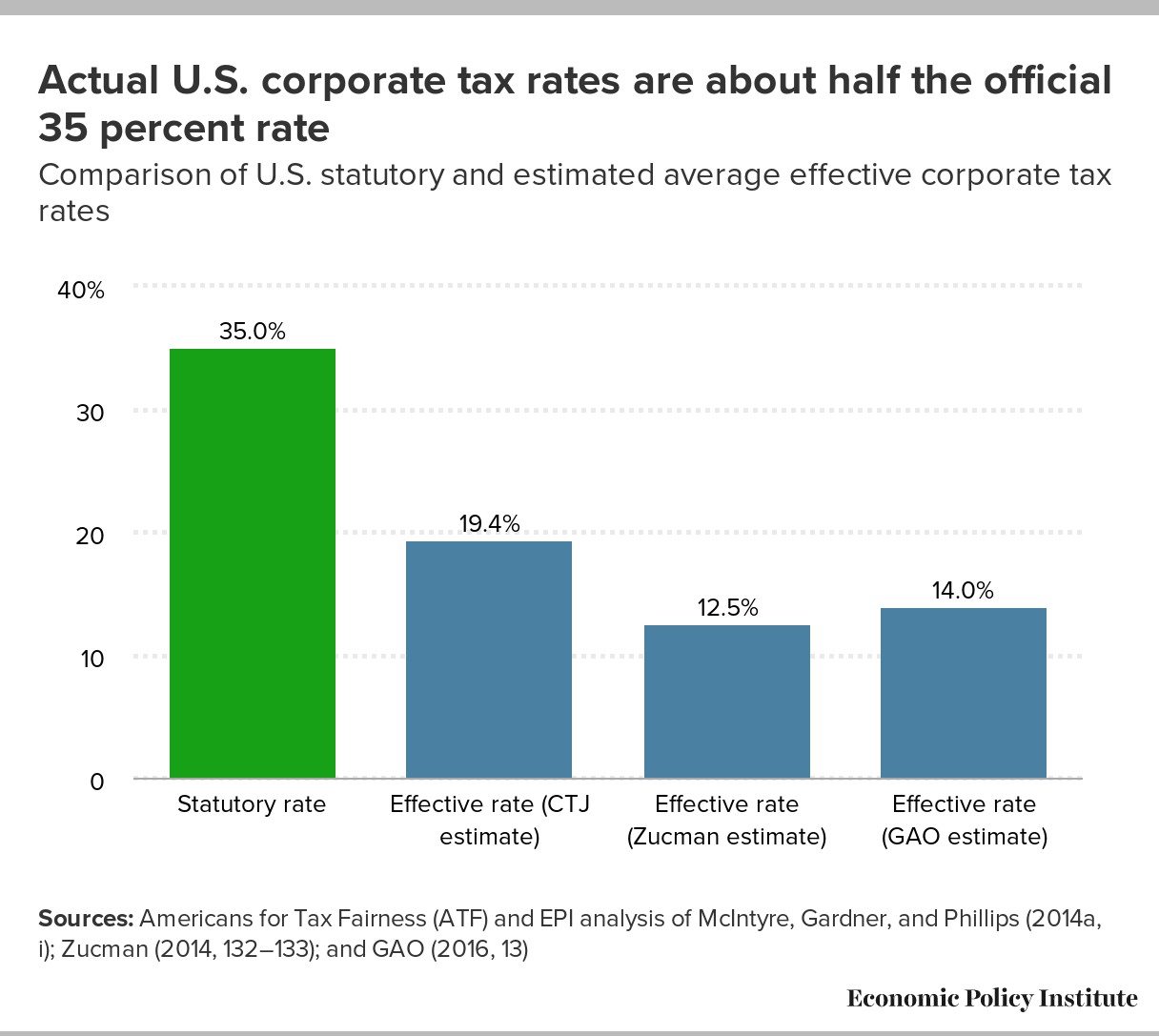

Cutting Corporate Taxes Will Not Boost American Wages Economic Policy Institute

Corporate Income Tax Cit Rates

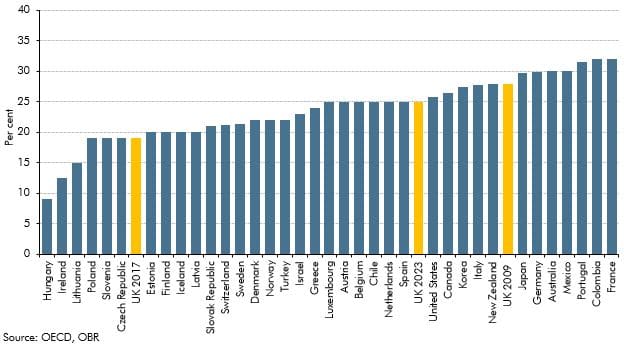

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute

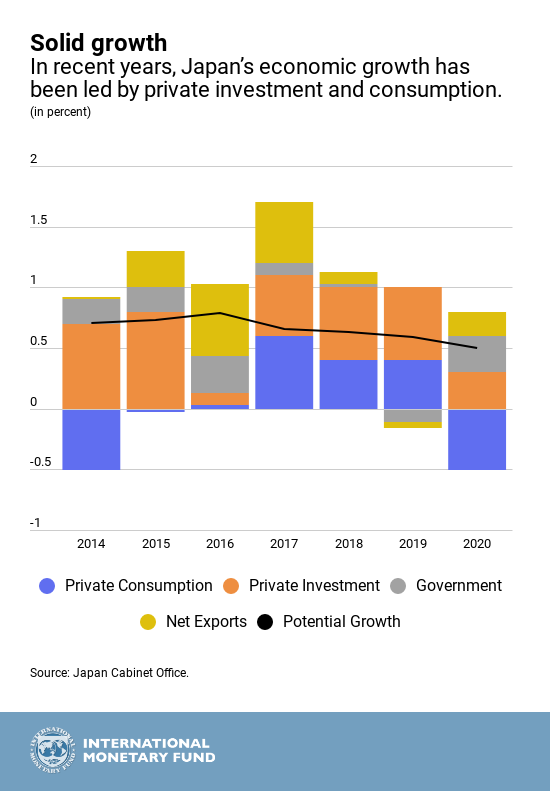

Japan S Economy In 5 Charts World Economic Forum

Austria Tax Income Taxes In Austria Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Tax Reform In The Wake Of The Pandemic Itep

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Competitive Distractions Cutting Corporate Tax Rates Will Not Create Jobs Or Boost Incomes For The Vast Majority Of American Families Economic Policy Institute

Japan Total Corporate Ordinary Profits Of All Industries 2020 Statista